New Zealand's Best Dividend Stock? This Powerhouse Pays a 7.2% Dividend Yield

The yield won't stay this good for long

Hello Investor,

New Zealand's stock market offers hidden opportunities.

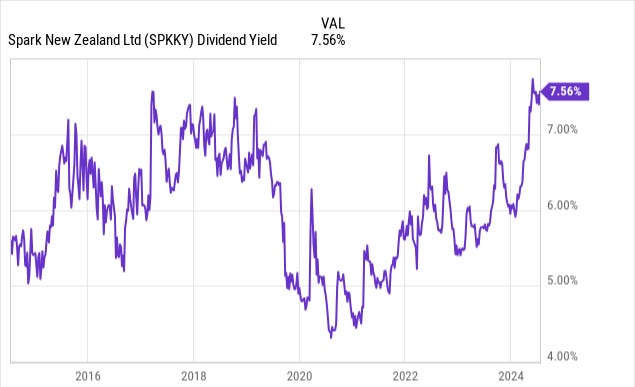

I've identified a promising company with a 7.2% dividend yield, consistent stock price growth, and a strong competitive advantage. It's one of the most highly capitalized stocks in the country. This high yield may be temporary, as I expect the stock price to recover soon.

Want to learn more about this potential bargain? Let's explore further.

Spark New Zealand (ADR:SPKKY)

🛒 Industry: Telecommunications

💰 Market capitalization: $4.58 billion USD

📈 Dividend yield: 7.2%

🌱 Dividend growth rate (5YR): 4.72%

💵 Stock price: $12.52 USD

🌎 Country: New Zealand

⭐ My Rating: 4/5

Spark New Zealand is the country's largest telecommunications and digital services company.

In a nutshell, here’s why you should consider buying it.

As New Zealand's #1 mobile provider with 44% market share, Spark benefits from a dominant position in a politically and economically stable country. Spark is also a Kiwi icon, which serves as a natural competitive moat.

Beyond traditional telecom, Spark is expanding into high-growth areas like 5G (now in 95 locations), data centers (including a new 40MW facility), and IoT (1.8 million connections), positioning itself for future revenue streams.

With adjusted revenue up 1.3% and EBITDAI growth of 3.9% in H1 FY24, coupled with a cost reduction program on track to exceed targets, Spark demonstrates solid financial management.

The dividend is well-covered by free cash flow despite strong capital expenditures planned for 2024.

Alongside its high dividend, Spark's ongoing share buyback program (having returned $305 million to date) is another key benefit.

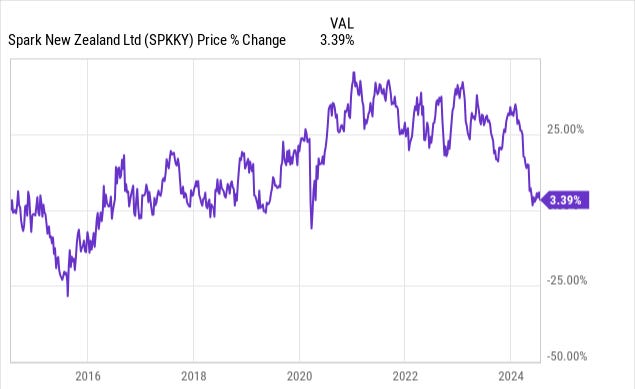

The stock is near COVID lows and is poised for a rebound.

Performance

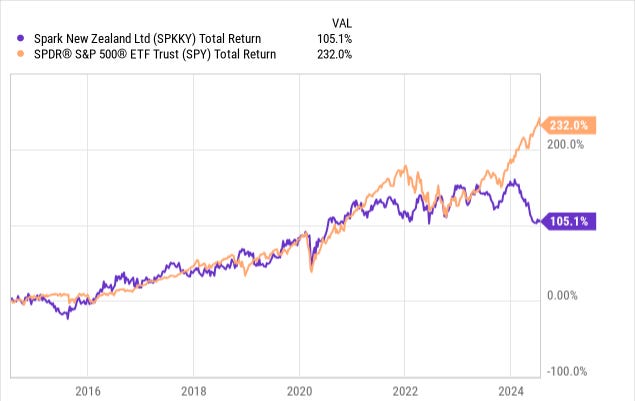

Until very recently, SPKYY has offered a total return comparable to the S&P 500 over the last decade, with significant periods showing outperformance.

In my view, it provides this return with less risk, as its dividend yield has consistently hovered around the 6-7% mark. Its five-year dividend growth rate is 4.72%.

Spark’s stock price has grown steadily despite the high dividend yield, which is a unique benefit to investors.

Valuation

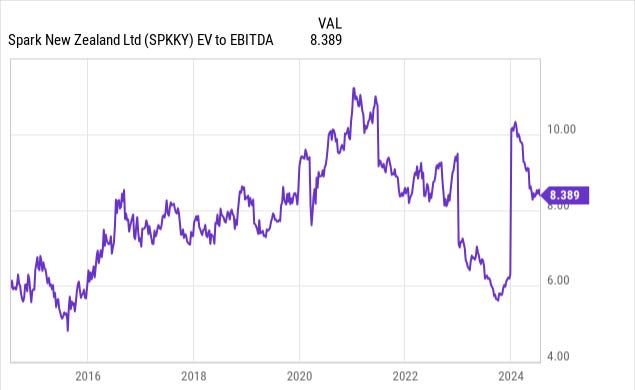

Spark is priced to perfection.

The 2024 EV/EBITDA of 8.4 is still below the peak of 10 in 2020. This suggests there's room for further valuation expansion.

The sell-off coincided with it reducing its FY24 EBITDAI guidance to $1,170-$1,210 million due to weaker IT demand and softer device sales. Mobile and broadband performance remains stable. Capital expenditure and dividend guidance unchanged.

The current challenges appear cyclical rather than structural with its core business unaffected. Falling interest rates, abating inflation, and a political climate now more friendly to businesses with a newly elected government will aid in its recovery.

Takeaway

Now is a great time to consider buying Spark. It seems unlikely it will continue falling given the downside has already been priced in while the NZ stock market has soared 5.08% year-to-date.

The expected strengthening of the NZD against the USD is another benefit, with the U.S. near or at the peak of its interest rate cycle.