Hello, Investor,

Researching dividend stocks is my passion and I know in my heart it’s what God put me on Earth to do for others. I have a background in accounting and I’m also a volunteer financial counselor through my local chamber of commerce.

I have a sterling dividend growth stock for you today.

This company is a great pick if you value total return, as its stock price has increased 137.11% over the past five years. This is while also growing its dividend for 52 years in a row, making it a Dividend King of Kings.

I believe this company has some of the best value in the S&P 500, so let’s dive in.

Lowe's Companies (LOW)

🛒 Industry: Home improvement retail

💰 Market capitalization: $133.9 billion

📈 Dividend yield: 1.89%

🌱 Dividend growth rate (5YR): 18.04%

💵 Stock price: $232.17

📊 Wall Street rating: "Buy"

⭐ My Rating: 4.5/5

Lowe’s Overview

I've been following Lowe's for years as an investor and home improvement enthusiast and it continues to be one of my favorite dividend stocks.

Lowe’s operates over 2,000 stores across North America, competing primarily with Home Depot (HD), and is America's second-largest home improvement retailer. The company has a single operating segment and has a sole presence in the U.S. after the sale of its Canadian franchise.

Lowe’s business is straightforward. To me, this is a good reason for investors to consider the company, because as Warren Buffett once said:

“Never invest in a business you cannot understand.”

My seven-year-old niece can grasp what Lowe’s does, and this ease of analysis also means we can be more certain of our future predictions due to there being less moving parts to the business.

Financially on a net sales basis for last year, Home Décor leads with 37.2% ($32,130 million) of total sales, followed by Building Products at 31.1% ($26,894 million), Hardlines at 29.0% ($25,020 million), and Other at 2.7% ($2,333 million).

Growth in these segments has slowed down somewhat from FY2021 to FY2023. I don’t find the slow down particularly alarming. In fact, one has to take into consideration COVID-19 as being a major tailwind for the business with people doing more DIY during lockdown. With COVID being a black swan event, we shouldn’t factor it in as part of its regular performance either.

I think Lowe's is a smart buy right now, even with the current squeeze on margins. Sure, interest rates, inflation, and commodities are causing some turbulence, but I'm convinced it's just a temporary blip.

Lowe’s sold off its Canadian arm, which was about 5-6% of sales. But here's why I'm bullish: Lowe's is rolling out Pro supply branches across the country, targeting contractors and builders. It’s a smart move.

Pros are less fickle about prices and they buy more often. With regular consumers feeling the pinch of inflation, this pivot couldn't come at a better time.

In my view, this strategy sets Lowe's up for solid growth. The stock's down now, but that just screams "opportunity" to me. I say buy low, ride it out, and watch it climb.

Outlook and guidance

Broadly, Lowe’s is following a Total Home Strategy that consists of the following pillars:

Drive Pro penetration: Increase focus on and sales to professional contractors and builders.

Accelerate online business: Enhance and expand e-commerce capabilities and digital sales channels.

Expand installation services: Grow the range and volume of professional installation services offered to customers.

Drive localization: Tailor product offerings and marketing to specific local markets and preferences.

Elevate assortment: Improve and diversify the range of products available to customers across categories.

This approach not only addresses current market trends but also builds resilience against potential future disruptions. However, the success of this strategy will hinge on Lowe's ability to execute effectively across all five pillars while maintaining operational efficiency. I expect the company to incrementally unlock value over time.

Lowe’s posted the following guidance for the year with its first-quarter results for 2024. I’ve included a comparison and an analysis of the results it posted in FY 2023.

Total sales:

FY2023 result: $86,377 million

2024 guidance: $84 to $85 billion This represents a projected decrease in sales.

Comparable sales:

FY2023 result: -4.7% decrease

2024 guidance: -2% to -3% decrease This suggests a slight improvement in comparable sales, though still negative.

Operating margin:

FY2023 result: 13.38%

2024 guidance: 12.6% to 12.7% This indicates a slight decrease in operating margin.

Interest expense:

FY2023 result: $1,382 million

2024 guidance: Approximately $1.4 billion This is relatively consistent with a slight increase projected.

Effective income tax rate:

FY2023 result: 24.1%

2024 guidance: Approximately 25% A slight increase in the tax rate is expected.

Diluted earnings per share:

FY2023 result: $13.20

2024 guidance: $12.00 to $12.30 This projects a decrease in earnings per share.

Capital expenditures:

FY2023 result: $1,964 million

2024 guidance: Approximately $2 billion This shows a slight increase in planned capital expenditures.

Overall, the 2024 guidance suggests a slight contraction in the business compared to FY2023 results, with lower sales, comparable sales still negative (though improving), lower operating margin, and lower earnings per share. However, the company is planning to maintain or slightly increase its capital expenditures to help it execute its Total Home Strategy.

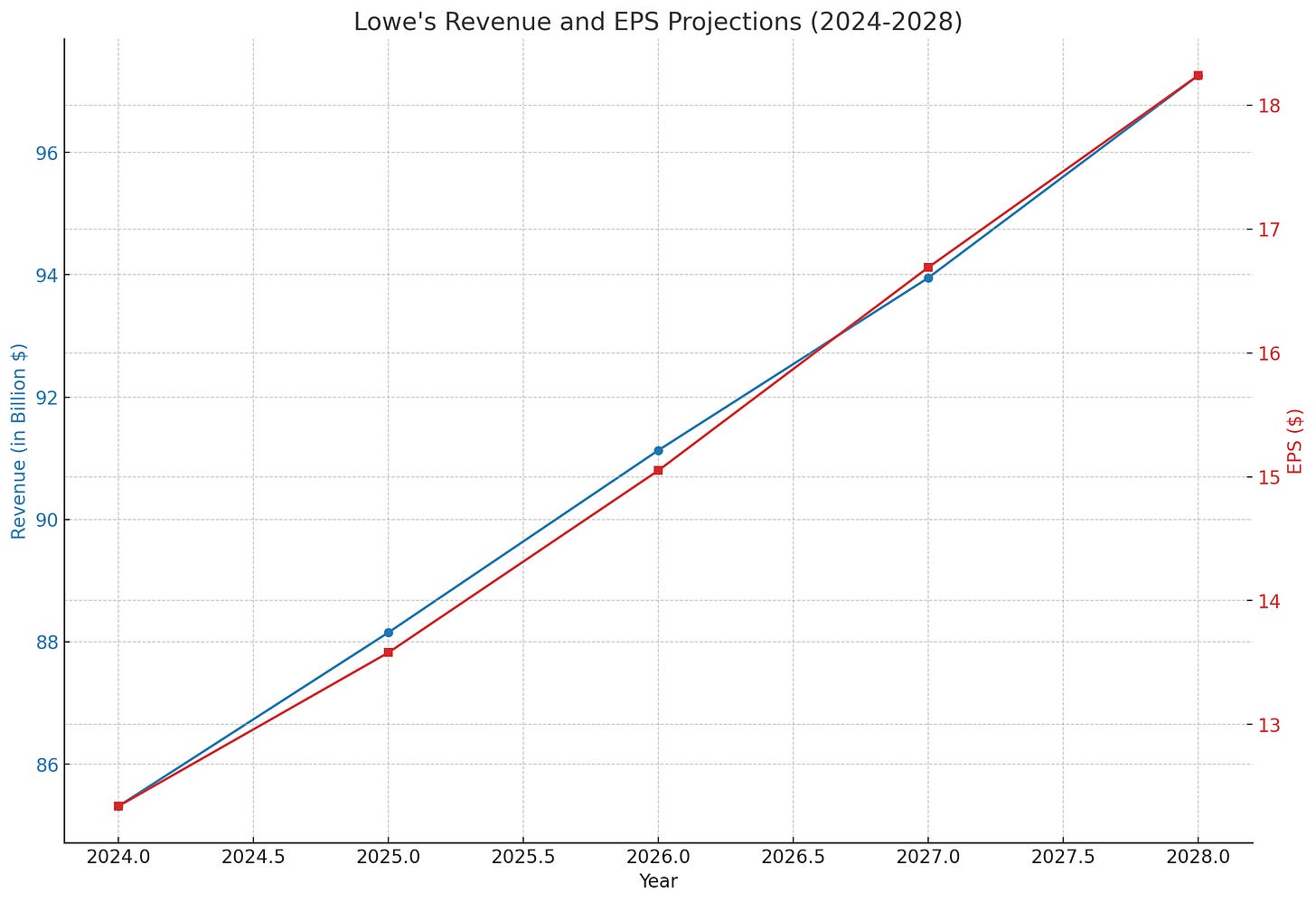

Lowe's is projecting slightly lower performance for 2024 compared to analyst expectations:

Revenue: Lowe's expects $84-85 billion; analysts predict $85.31 billion.

Revenue Growth: Lowe's projects -2.75%; analysts forecast -1.23%.

EPS: Lowe's guides $12.00-$12.30; analysts expect $12.34.

EPS Growth: Lowe's implies -7.27%; analysts predict -6.54%.

Overall, analysts are marginally more optimistic than Lowe's official guidance, with 38 analysts contributing to the consensus. Both Lowe's and analysts anticipate some contraction in 2024, but analysts foresee a slightly better outcome in terms of revenue, revenue growth, and earnings per share.

Catalysts

As a long-term investor in Lowe's, I'm particularly excited about three key catalysts that I believe will drive the company's growth and shareholder value in the coming years.

1.) Aging U.S housing stock

First and foremost, I'm impressed by the long-term tailwinds created by the aging US housing stock. It's striking to me that the median home age in the USA is now around 43 years, with a significant portion of owner-occupied homes over 50 years old.

As these older homes require more frequent repairs, renovations, and updates, Lowe's is perfectly positioned to capitalize on this ongoing need. I see this as a reliable source of business that should persist regardless of short-term economic fluctuations.

2.) Lowe’s bought back 42% of its shares outstanding

Secondly, I can't overlook Lowe's aggressive share repurchase program. The fact that they've bought back 42% of their outstanding shares over the past decade speaks volumes about their commitment to returning value to shareholders. It also signals management's confidence in the company's future prospects.

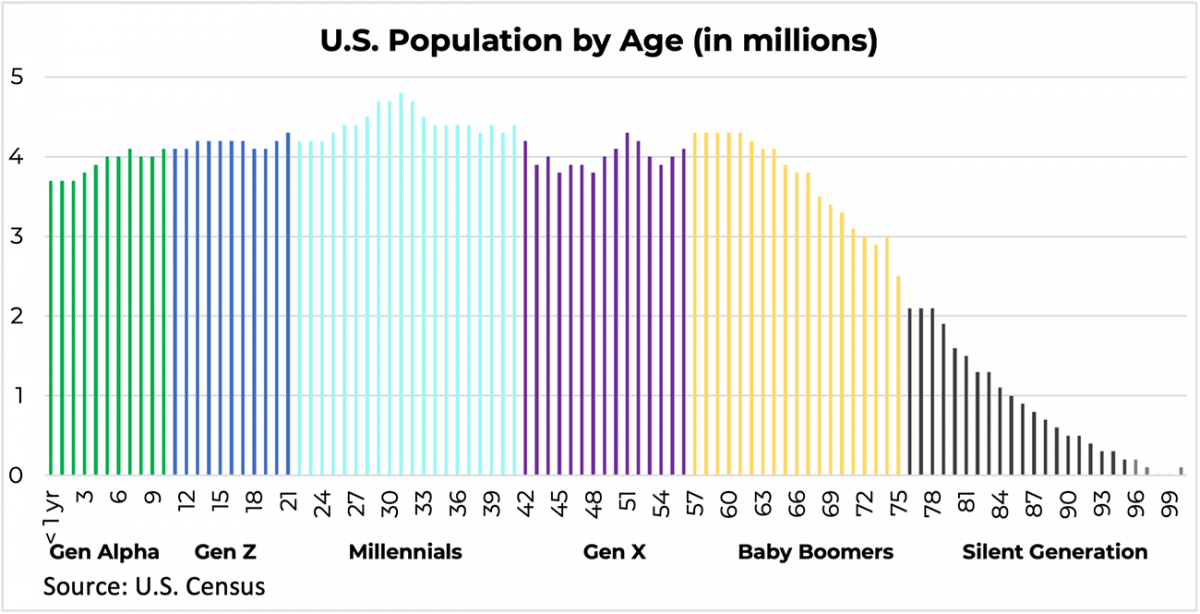

3.) Aging Millennial generation

The aging millennial population in the U.S is a catalyst that I believe many are underestimating. Millennials, now in their 30s and early 40s, are entering their prime home-buying years en masse. As this generation transitions from renters to homeowners, they're driving a surge in demand for home improvement products and services.

What's fascinating to me is how this trend intersects with the current housing market dynamics. With limited inventory of new homes and high prices, many Millenials are opting to buy older homes that need work. This plays right into Lowe's wheelhouse.

So from my point of view, there are many good reasons for investors to believe that Lowe’s will be able to bounce back from the short-term weaknesses it has shown and continue to move from strength to strength.

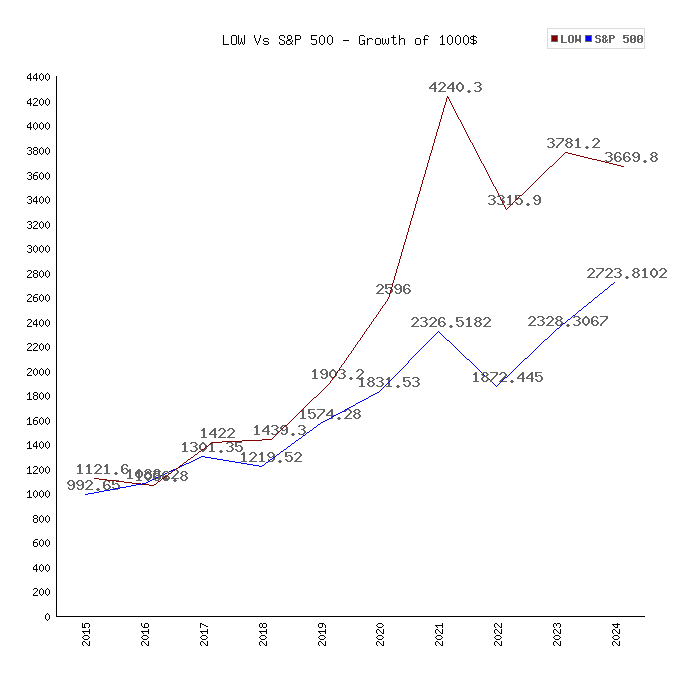

Dividend and total return analysis

If you had invested $1,000 into Lowe’s ten years ago, you would have $3669.8 today, assuming you reinvested each dividend. You would have outperformed the S&P 500 over the same period by $946.7, or around 34.70%. Impressive.

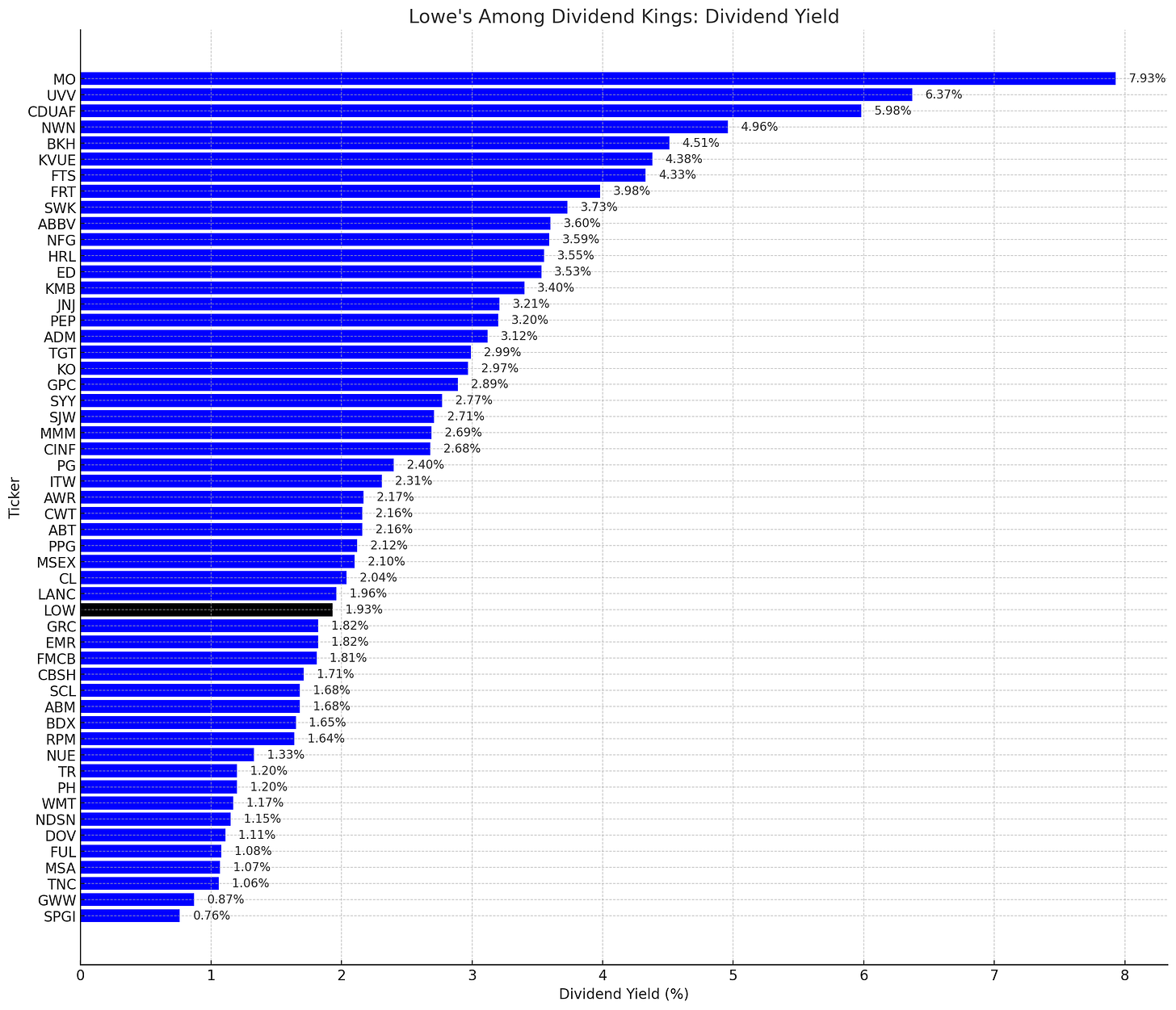

But let’s talk one of Lowe’s weaknesses, which is its dividend yield. At 1.93%, it may be too low for those who need to rely on immediate dividend income without selling shares. If you invest $10,000 in Lowe’s, you’d receive around $48.25 each quarter in dividends.

Lowe’s dividend yield is slightly below average when compared with other Dividend Kings, as can be seen below.

Lowe’s dividend yield of 1.93% is also substantially below that of its main peer, Home Depot (HD), which pays a dividend of 2.48%.

However, I’m not particularly worried about Lowe’s low yield for the following reason. When investing in dividend stocks, we face trade-offs similar to those encountered when buying a car. With cars, you typically can choose only two out of three desirable qualities: affordability, reliability, and speed. Similarly, with dividend stocks, a high dividend yield almost always comes at the expense of long-term capital erosion and low dividend growth rates. You either get a high dividend yield, or nothing.

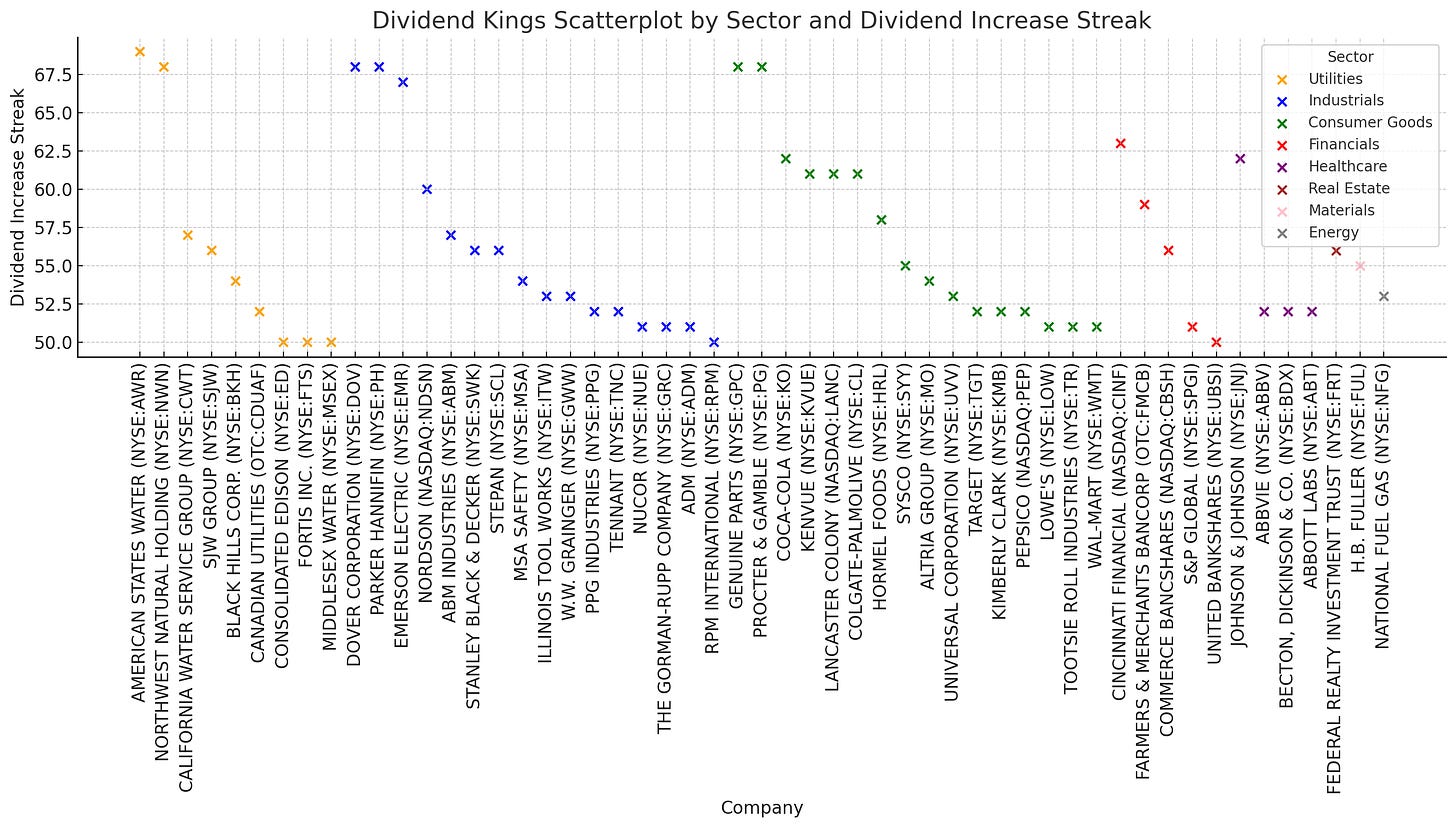

Lowe’s is also still positioned competitively when one views its dividend increase streak compared with other companies in the Consumer Goods sector, and among other Dividend Kings.

Crucially, however, Lowe’s offers strong dividend and capital growth. Out of the entire dividend aristocrat universe, Lowe’s offers the third-highest dividend growth rate with an 18 percent CAGR.

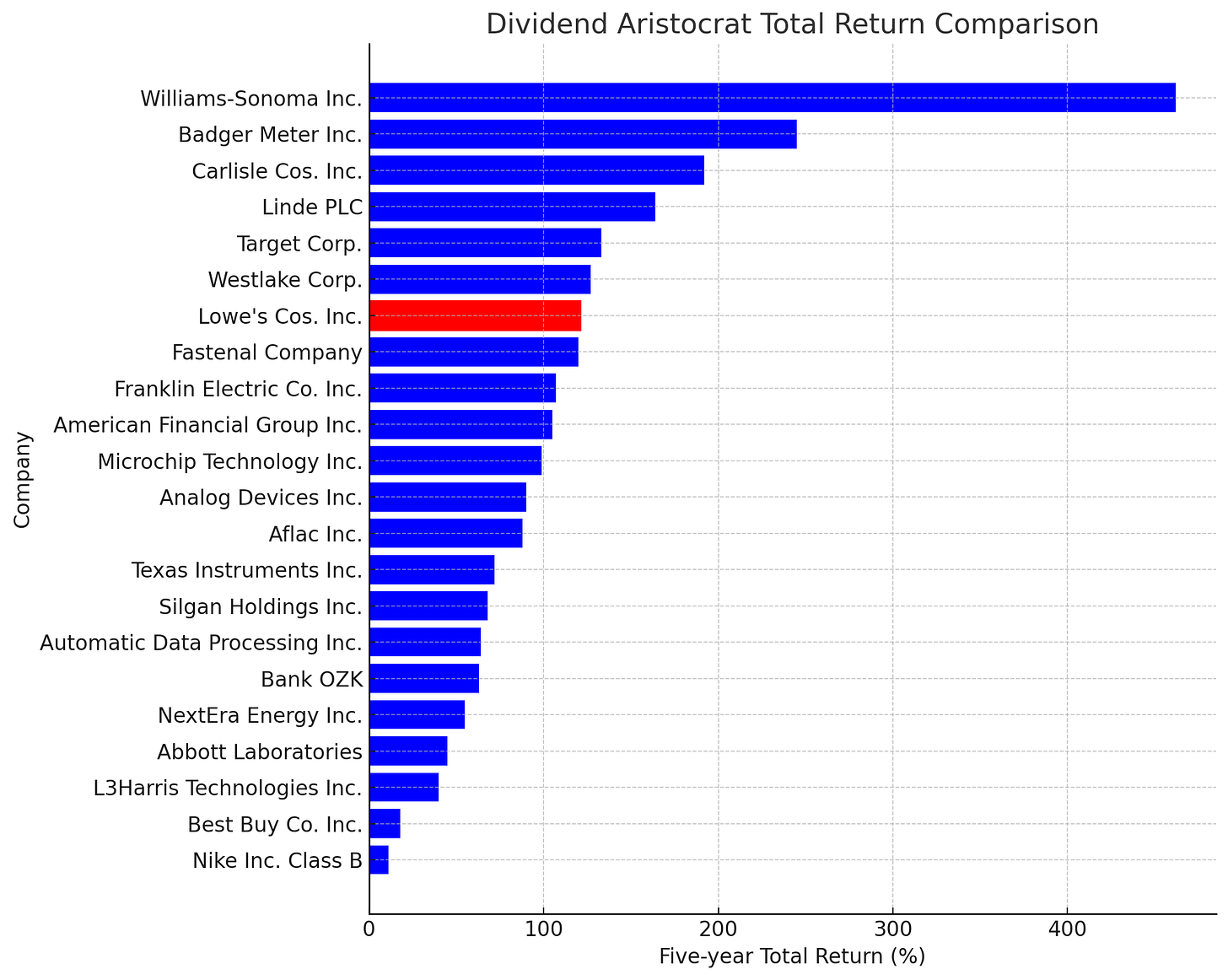

Finally, on a five-year total return basis, Lowe’s also fits into the upper quartile over the last five years. I expect that due to its lower dividend yield than average and aggressive dividend increase streak that it will outperform the the other aristocrats on this list.

Takeaway

Lowe's presents a compelling investment opportunity for dividend growth investors. Despite short-term headwinds, the company's strong market position, aggressive share repurchase program, and favorable long-term catalysts make it an attractive choice. With its impressive dividend growth rate and solid total return potential, Lowe's stands out among Dividend Kings.

Don't miss out on more in-depth analyses like this! Subscribe to our newsletter now to receive regular insights on dividend stocks and stay ahead in your investment journey. Have thoughts on Lowe's or want to suggest the next stock we should cover? Leave a comment below – your input helps shape our community and future content.